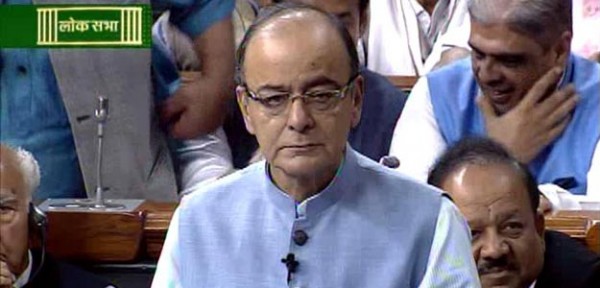

Good news for small taxpayers! While presenting his third Union Budget in Lok Sabha, Finance Minister Arun Jaitley on Monday announced three new measures to provide relief to small taxpayers in Budget 2016.

1) Mr Jaitley increased the deduction limit under Section 87A of the Income Tax Act from Rs. 2,000 to Rs. 5,000 per annum. Under Section 87A, taxpayers first reduce Rs. 2,000 from their total tax payable. This section applies to those with total income of less than Rs. 5 lakh.

Though, Finance Minister didn’t announce any change in current tax slab, he said that the move will help more than 2 crore taxpayers.

2) The finance minister also announced relief for taxpayers who do not own a house and don’t get house rent allowance from employers. So far, such taxpayers got a relief of Rs.24,000 per year, which has now been raised to Rs. 60,000 per annum, Mr Jaitley said. The measure will provide “relief to those in rented houses”, the finance minister added.

3) Mr Jaitley also announced an additional deduction of Rs. 50,000 on interest paid by first-time home buyers on home loans of up to Rs. 35 lakh, provided the house value doesn’t exceed Rs. 50 lakh.

Minister also announced 9 pillars for transforming India which includes agriculture, rural sector, social sector, education and job creation, infrastructure investment, financial sector reforms, governance and ease of doing business, fiscal discipline and tax reforms. Among major announcements was one for LPG connections for poor women, which he said would benefit 1.5 crore households this year.